Overall, 2021 has been another stress-test for the financial industry and investors had a hard time to allocate their resources efficiently. Regulators all around the world, established financial institutions and institutional investors increasingly locked their focus on digital SME lending platforms, closely eying their ability to distribute capital, process loan request rapidly and efficiently and the unique investment opportunities they offer via the asset class of Digital SME loans.

Even though Digital SME lending is still relatively young, its sound fundamentals and far-reaching value proposition indicate, that investors can unlock significant benefits for their portfolio while the credit platform economy will continue to shape lending as we know it.

In an earlier blogpost we were talking about the results of our study concerning Digital SME loans (download here) and how Digital SME loans should have a place in every financial institution portfolio.

Now it’s time for us to share with you another central characteristic of this asset class:

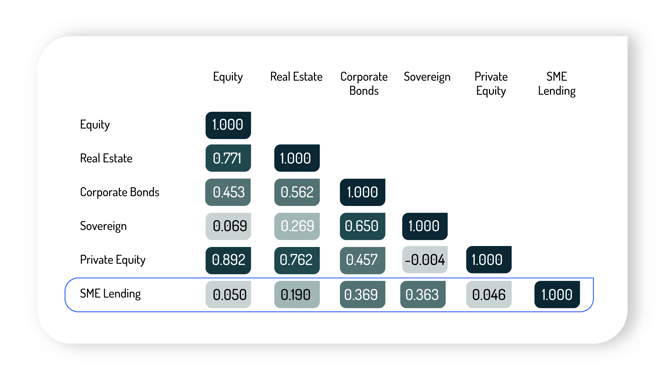

Digital SME lending returns show a low correlation with the other most prominent asset classes, leading to a great diversification effect in the portfolio.

With the sample given below, our findings indicate that Digital SME lending returns are not meaningfully corelated with the other asset classes, allowing Digital SME loans to have a real diversification effect in the portfolio.

As another result, we would expect the characteristics of Digital SME lending returns to be also different to private debt and other subsequent asset classes.

Consequently, Digital SME lending returns exhibit very interesting characteristics which makes it promising asset class for institutional investors to consider in the context of portfolio construction.

If you want to know more about this, please feel free to download our study here or contact us directly at debtinvestor@creditshelf.com.