In the current low yield environment, the traditional credit market is a less viable option for investors. At the same time the stock market is also appearing to be difficult to anticipate. Consequently, investors look for alternative investment options to muddle through. Our study, which we conducted with Exaloan AG, shows how the addition of SME loans into the asset mix can help investors to diversify their portfolio, reduce risk and optimize returns.

As we have often shown, digital lending platforms, like creditshelf, have emerged as a viable alternative to local banks for borrower segments like SME, who are undeserved or overlooked even in established markets like the German economy.

Given the backdrop of record low interest rates, investors are increasingly hunting for yield in alternative credit segments.

In this context, digital SME Lending is emerging as a new asset class with interesting properties to enhance returns and diversify the asset mix.

But why do we think Digital German SME loans can achieve these properties. Let's compare asset classes!

Digital SME loans vs. other asset classes

We came across two major breakthrough insights while conducting our research.

Digital SME Lending has:

- An investment performance with equity-like return potential.

- Strong potential to enhance returns and add value to asset mix.

These two insights are well illustrated by our analysis of the ECB database (2011-2021).*

*Study conducted by Exaloan AG in cooperation with creditshelf AG

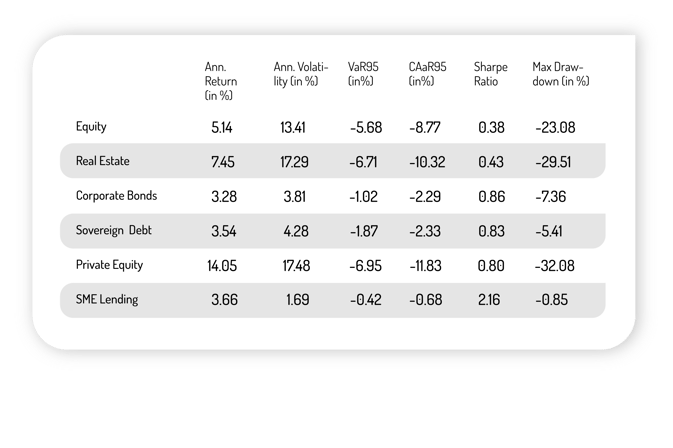

We used the monthly total return indices of the MSCI Europe, MSCI Europe Real Estate, LPX Europe Listed Private Equity, iBoxx EUR Non-Financials and iBoxx Sovereigns Eurozone as benchmarks for investment returns.

Our research has shown that the yield pick-up of SME lending in comparison to corporate bonds is decent (3.66 -vs- 3.28 for the last 10 years according to ECB data).

But more importantly, there is a substantial advantage in volatility (1.69 -vs- 3.81) resulting in an attractive risk-return pattern (Sharpe Ratio of 2.16 -vs- 0.86) when it comes to Digital SME loan investment.

As a conclusion, this allows the introduction of the hypothesis that the potential benefits of Digital SME lending in terms of yield and volatility can be well captured by investors who want to enhance and diversify their portfolio returns through integrating this exciting alternative asset class into their strategic asset allocation.

This is why we think that Digital SME loans should be a part of every financial institution´s portfolio!

If you want to know more about this, please feel free to download our study here or contact us directly at debtinvestor@creditshelf.com