In today´s difficult low-yield environment institutional investors are increasingly interested in alternative credit investment opportunities to stabilize their portfolio´s risk/return balance.

Because of this notion, we now want to shed some light on a phenomenon that we have identified in the process of our research as the complexity premium of Digital SME loans.

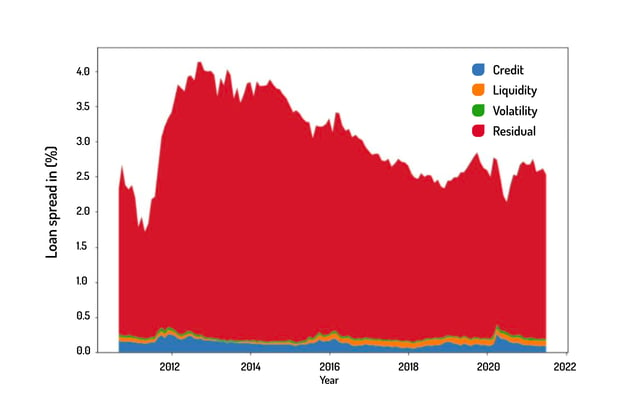

Now let us take a closer look at the following figure, which illustrates the loan spread decomposition of Digital SME loans according to our findings.

Yes, this looks complicated but let´s briefly explain what we see.

Normally, loan spread composition for private debt, and thus also Digital SME loans as a sub-segment, consists out of three main components:

- credit risk (blue)

- volatility risk (green)

- liquidity risk (orange)

In a perfectly informed market, the price of a loan should normally be fully explainable through the means of risk, volatility, and liquidity.

We now see that these three main components only explain a fraction of the loan spread (red) we identified for Digital SME loans while conducting our study, the rest is explained through what we call the “complexity premium of Digital SME loans” (red).

Unlocking the complexity premium

But what does this premium mean and why is its occurrence not surprising for us?

Due to the highly fragmented nature of the digital SME lending space, the absence of market standards and the high technological barriers to make this asset class accessible via scalable investment processes digital SME loans remain locked for non-specialized institutional investors.

The identified complexity premium therefore shows that it is difficult for non-specialized market participants to correctly evaluate the underlying risks of a loan.

Our research allows to conclude that investment into Digital SME loans via FinTech platforms is a great way for institutional investors to unlock an attractive premium on their investment while further enhancing returns and generating portfolio diversification!

If you want to know more about this, please feel free to download our study here.