No collaterals

Disbursement within 4 weeks

In-depth understanding of innovative business models

No equity kicker and without subordination requirement

On this basis, we determine feasibility and initial indication, which we are happy to discuss in detail.

Subsequently, we require the following for further processing (please submit successively):

Friendsurance

"Startups often get funding from business angels and venture capital funds, but rarely loans - certainly not in times of Corona. In the first quarter of 2020, investments in insurtechs halved worldwide. The fact that we got funding so quickly through creditshelf shows how compelling and solid our business model is."

Download whitepaper here

The Female Company

"I like the fact that creditshelf checks its investments very carefully at the beginning to see if financing is worthwhile and that I have the freedom to concentrate on building up the company afterwards instead of preparing monthly reports."

Targomo GmbH

"Thanks to the venture debt light loan from creditshelf, we were able to invest more in the further expansion of our sales and marketing team. The unsecured financing therefore came at exactly the right time to further accelerate our growth - thanks to an equally fast and smooth process!"

JOBMATCH.ME

"For us, creditshelf is an absolute added value due to its speed and we were impressed by the uncomplicated processing as well as the competent and very customer-oriented employees. At JOBMATCH.ME, we focused on profitability at a very early stage. This opened up financing opportunities beyond VC without further dilution. The capital now provided by creditshelf allows us to continue sustainable growth while keeping the momentum high, which is super important for us as a digital platform."

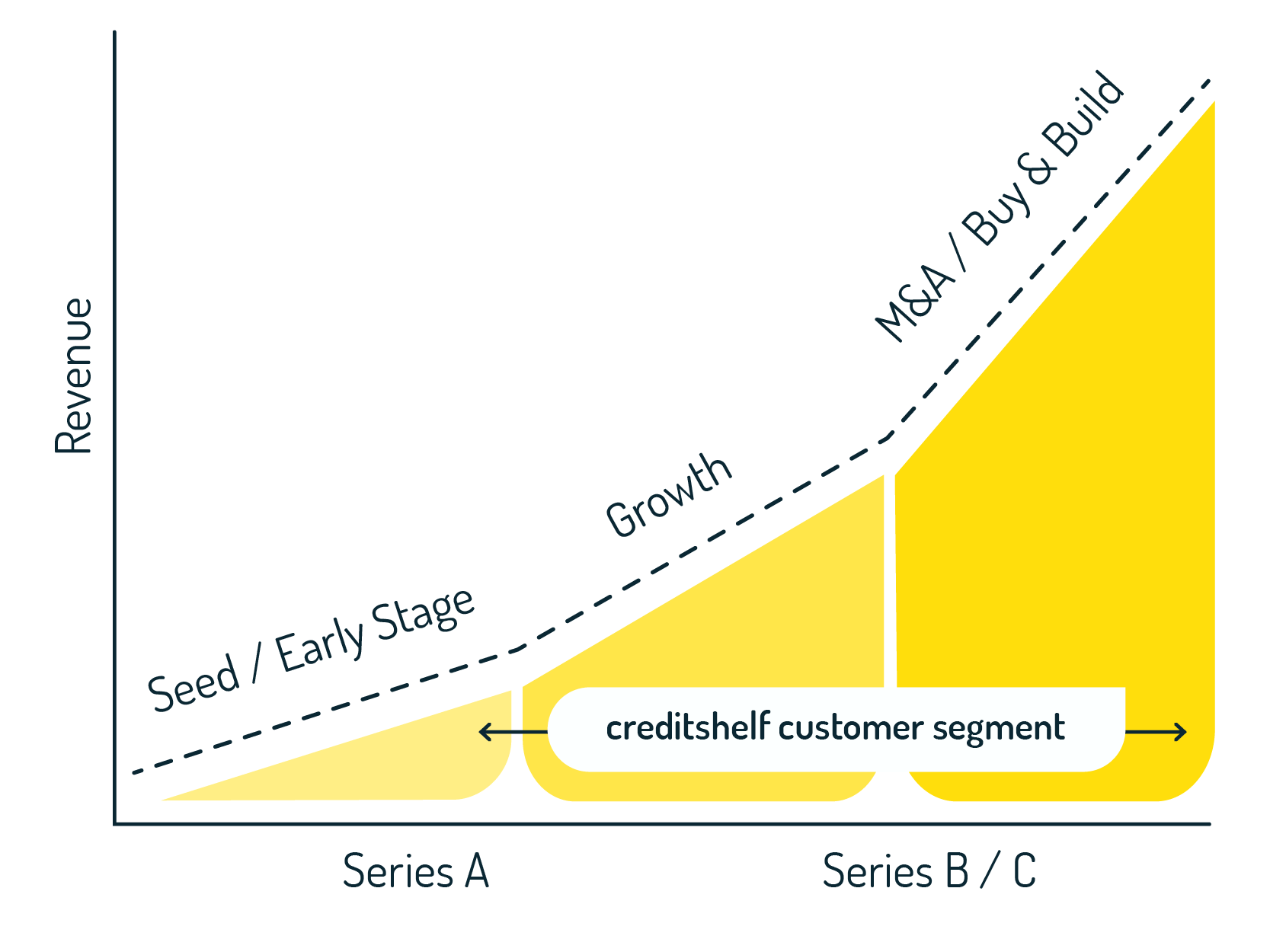

Especially for companies between the "start-up" phase, product-market fit and sustainable establishment, it is important to design the right financing mix.

With "Venture Debt Light", we enable tech growth companies to access debt capital at an early stage and offer a suitable supplement to equity financing. In doing so, we avoid dilution of company shares and are independent of the investment climate on the market. Our expertise lies in supporting companies from a seed / early stage or Series A round onwards, in which well-known investors are already involved.

The advantages of Venture Debt light are manifold and can vary depending on the market situation. For example, it can be used to circumvent down rounds, provide quick access to liquidity without valuation issues or avoid dilution at strategically important times. In addition, it may make sense to combine venture debt light with a smaller equity round to further drive the growth of the company. In any case, Venture Debt Light is a valuable financing component for emerging technology companies.

To differentiate: classic Venture Debt that comes with so-called equity kickers (warrants) will usually only delay dilution, not prevent it. Our Venture Debt Light does not dilute participating founders, existing investors or employees incentivised via ESOPs. We structure our Venture Debt Light with fixed, non-floating interest for the term of the loan in order to enable market –independent planning and thus security during our commitment – which in turn is in the interest of all investors, so that sufficient cash flow can be made available for future growth.

Conversely, it is clear that our venture debt light is not an equity round per se, but can be a sensible building block for combination with one - or (also simultaneously) serve to extend the runway, be used as a growth accelerator for e.g. marketing or further market development, or to pave the way for subsequent, more attractive equity rounds.

creditshelf's scale-up solutions close the gap between venture capital and the traditional banking market. This gives growth companies early access to debt capital and an alternative to equity financing - without dilution of the company's shares!

Financing mostly young growth companies requires know-how and analysis expertise. With the help of our unique, data-driven risk analysis, we can analyze the financial information from the accounting system quickly and in depth. Specialists for growth base their transparent decisions on the data derived from the ERP. Within a few days, the borrower receives an initial offer from us. The rest of the process is also carried out digitally, quickly and reliably via our creditshelf platform until the loan is disbursed.

Even though banks and some fintechs are active in the business field of lending, there are still significant differences in the work processes. With fintechs, the business model – in contrast to the banking sector – is based on the use of technical solutions, with a focus on customer needs and versatile services. In this context, creditshelf's credit platform, for example, bundles all processes from the first non-binding credit request to the risk analysis and the credit arrangement to monitoring during the term. As a rule, this process takes more time at banks, starting with the arrangement of an initial appointment on site, through extensive manual form processing to long decision-making processes. With fintechs, the exchange during the credit process can also be designed interactively on the platform thanks to their software solutions. Risk analysts, corporate client advisors, operations managers and clients can view current work statuses at any time and communicate with each other via messages.

In addition, the system notifies those involved as soon as action is required at any point in the process. Thanks to automated analysis processes during the lending process, the system recognises when discrepancies arise that need to be clarified personally by the employees with the customer. In addition, the API system used at creditshelf can also be coupled with other software solutions for accounting and creditworthiness checks or also integrate services from third-party providers.

Companies usually receive the first information on a credit application within 48 hours. The entire lending process usually takes only a few weeks. To what extent banks can offer such speed and efficiency due to their technology depends on the individual state of digitalisation. In addition, decisions in the banking environment usually go through many levels, which in turn means additional time.

In fintech companies, the technical underpinning and control of all processes are standard and form the basis of the business model. creditshelf also differs from most traditional credit institutions in that it has its own internal scoring system for assessing creditworthiness. In addition to typical criteria such as annual turnover, this also takes into account the size of the company, its form and future potential. Furthermore, creditshelf arranges the granting of unsecured loans, which are rarely granted by banks.

There are a total of four phases before a loan is granted by creditshelf. Below you will find an overview of the individual steps:

The first step to request a loan starts on creditshelf's website. After entering the contact details of the inquirer and the company, including the amount of credit required, the system checks the company in the form of a risk engine using data from external sources such as credit agencies or the commercial register and draws up a risk analysis.

After successfully passing the first step, the company must next submit documentation on trial balance statements or financial statements, which the software uses to determine a rating score. In addition, this phase includes the review of further exclusion factors.

In the third step, risk analysts manually check the automatically generated scoring and consult other credit-relevant documents such as account statements. In a due diligence call between contacts from the analysis team and the requesting company, any outstanding questions regarding the risks and opportunities of the business are then clarified and, if necessary, critical points are reviewed again in the follow-up. If all the prerequisites for an award are met, the next step is to make a credit decision in accordance with the dual control principle. Often, the first payment for scale-up financing is made just a few weeks after the initial digital application.

After the loan is granted is before the monitoring: throughout the term of the loan, the company continues to submit data online about business management evaluations or open items. Here, too, the software checks the information for risks or challenges. If this reveals a need for action, a human review of the given facts follows and the company is contacted.

![]() Unsecured loans from EUR 100,000 to EUR 5 million

Unsecured loans from EUR 100,000 to EUR 5 million![]() Disbursement within 4 weeks

Disbursement within 4 weeks![]() Fast, easy and digital loan request

Fast, easy and digital loan request![]() Personal and binding service

Personal and binding service

Monthly rate:*

€

Duration:

months

Loan volume:

€

*Example for best credit rating category

The realization of a scale-up project stands and falls with the right financing. Thanks to changing processes and technologies in finance, old regularities are being broken up and create room for new paths. Today, promising scale-up projects can be financed and implemented with unsecured fintech loans - often without having to go to the local bank.

Wir beantworten gerne Ihre Fragen:

Kundenbetreuung: +49 (69) 348 77 24-07

Zentrale: +49 (69) 348 77 24-0

info@creditshelf.com

creditshelf Aktiengesellschaft

Mainzer Landstraße 33a

60329 Frankfurt a.M.

Deutschland