Private Debt on the rise

Private debt investments have seen unprecedented popularity among professional investors and seem to have gained a permanent role in the composition of institutional portfolios. This trend is evidenced by record sums of money which are flowing into this fairly new asset class. Recent studies support the claim that private debt is becoming an ever more important building block within the financing strategy of Europe- an Mid-Cap companies, especially in the case of M&A transactions. For corporate borrowers without easy access to capital markets, the direct lending model has been filling the void left behind by banks in the aftermath of post-crisis restrictive banking regulation over the last decade. As a consequence, a handful of specialized asset managers like Ares or Bluebay have emerged on the international scene. Based on impressive track records and appealing risk/return profiles, institutional investors are eager to get a slice of the pie.

Smoke on the horizont

The rapid growth of private debt has raised concerns about how much money can actually be absorbed by the total available market. Financial markets have always been quite vulnerable to the threat of overcrowding in niche segments - a common phenomenon when too much money is poured into a limited opportunity set. Diminishing returns and/or less stringent standards on credit quality may well be a likely scenario for the most crowded financing deals.

It is also noteworthy to mention that most private debt managers have never gone through an entire economic cycle. This leaves investors with many uncertainties about the resilience of these investments in case of a market downturn. The flashy presentation of fund managers may imply that the performance of private debt in stress situations can be accurately simulated on the basis of (more of less suitable) assumptions from the past. Investors should take these statements with a pinch of salt. After all, one has to be well aware that the possibility of default is an inherent risk of private debt. However, those willing to take this credit risk are rewarded by (still) juicy returns compared to what the public market has to offer.

But not only traditional asset managers have shifted their focus on private debt by trying to exploit the market inefficiencies in the lending business to small- and medium-sized enterprises (SME). Over the last years, a new breed of players have entered the stage with the objective of matching investors and corporate lenders by the means of a digital platform. Could this platform lending model mitigate some of the typical risks associated with private debt? And what are the characteristics of loans originated by these platforms?

Platform lending taking a different path

Following the early advent of „peer-to-peer“ platforms pursuing retail money, the industry has gradually shifted towards institutional funding. Today, mature direct lending platforms such as Lending Club, Ratesetter or Zopa are predominantly backed by institutional investors. Among them are both private institutions such as Aegon or Goldman Sachs as well as supranational institutions such as the European Investment Bank, the European Investment Fund or KfW to only name a few. To facilitate capturing institutional investors, some SME platform lenders such as Funding Circle or October have recently launched fully regulated closed-ended funds. When it comes to fundraising, direct lending platforms increasingly resemble traditional asset managers who have been successfully distributing their assets through such fund vehicles for many years.

There is an ongoing discussion within the institutional investment community about the most notable differences between direct lending „1.0“ vs „2.0“ (platform business). In fact, both models are very similar as they seek to extract sustainable value from private credit. Still, there are some notable differences which are important to highlight towards investors looking to allocate capital in this space.

1. Use of technology to support data-driven decisions

Traditional private debt funds largely rely on offline deal sourcing and purely manual credit analysis. In comparison, platform lenders rely on technology both for loan origination through state-of-the-art inbound marketing, as well as for supporting the credit process throughout the entire credit value chain. Technology is vital when it comes to processing thousands of data points and finding patterns in this data to support decisions. At creditshelf, we have built tools allowing us to deep-dive into the accounting data of our clients at single book entry level. We also use software to cross-reference such accounting data with actual cash flows in bank accounts. Nevertheless, our final credit decisions are made by experienced individuals, who are supported by data-driven analytics and dashboard outputs. As we accumulate and analyze more data, we can make better credit decisions, thus creating better returns and attracting lower cost of funding. Technology allows faster processing of loans without compromising quality. Loans may be paid out within only one or two weeks, as opposed to a 16 to 20 weeks standard traditional direct lending process.

2. Granularity and portfolio diversification:

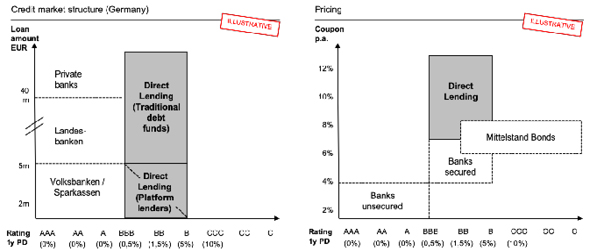

In Germany alone there are currently around 40 active debt funds, none of which is targeting individual loans below EUR 5m. In fact, most larger traditional players have their sweet spot in the EUR 50m to EUR 100m range. On the other hand, platform lenders are typically offering much smaller loans, some of which start even below EUR 100k. Depending on the platform, investors may invest evenly across the entire origination pipeline, leading to unparalleled portfolio diversification.

3. Target segment

The reason why traditional managers have a prefe- rence for larger borrowers (typically over EUR 10m EBITDA) with bigger ticket sizes is the constraint of covering the rather costly and cumbersome work of sourcing, analyzing and structuring each deal. Enabled by efficiency gains from technology and semi-automated credit processes, platform lenders can afford to target SMEs and smaller „Mittelstand“ companies - the most underserved client segment. This unique advantage should offer some kind of protection against the impact of overcrowding.

4. Transparency:

Platform lenders have a data DNA. This means they are able to provide a vast pool of data to their prospective investors, including a real-time view of the loan-book and performance and loss metrics. Some platforms offer this data publicly, others use NDAs and subsequently grant access to investors, allowing a deep dive into the numbers at level of the individual loan/borrower.

5. Sourcing bias:

Most traditional funds heavily rely on their network within the private equity / investment banking industry to generate sufficient deal-flow. Their loans are often originated in a transactional context, such as M&A or management buyouts. This leads to a certain dependency on the overall health of private equity, just as fears of a peak scenario are starting to spread among institutional investors. On the opposite, platform lenders typically build their own non-sponsored deal-flow across a number of distinct distribution channels.

6. Risk/return profile:

Private debt managers and platform lenders both target sub-investment grade corporate borrowers, i.e. ratings in the BB/B space where banks usually lend on a fully secured basis operating with very conservative loan-to-value or debt/EBITDA metrics. Although direct lending offers more flexibility to borrowers, this comes at a price of coupons in the higher single digits - often a significant mark-up over existing bank debt. Traditional private debt funds frequently use longer-duration bullet loan structures, whereas platform lenders usually rely on shorter duration, self-liquidating amortizing loans. This significantly reduces the risk from sudden changes in the interest rate regime.

Structural change in the German financing landscape:

Not so far apart

To conclude, whilst some key differences exist, at the essence both models aim at deliver superior risk-adjusted returns compared to debt investments available in public markets. Platform lending should be regarded as a valuable addition to traditional private debt investing with a much stronger emphasis on speed, data and technology. The cost-effective loan origination allows investors to access certain segments of the credit market that would otherwise be non-investable.

When looking for a suitable manager in direct lending, a good place to start is on evaluating the credentials of the investment professionals. Experience matters - more so in this industry than in most others. Unsurprisingly, the most successful traditional managers as well as platform lenders are run by senior finance executives. These individuals frequently have an investment banking or asset management background and are employing teams of experienced credit professionals.

Moreover, investors should get a clear signal that the manager is eager to constantly improve the proprietary credit model and is reacting to changes in the economic environment.

Regardless of whether the manager is pursuing a traditional or a platform model, they need to convince institutional investors to put their money at work without sacrificing on prudent financing standards. Only a thorough understanding of each borrower‘s credit profile as well as stringent credit management processes will achieve sustainable returns to investors in the long run.